2 Evaluating Your Medical Device Idea

William Durfee

Is My Idea Any Good?

You have a great idea for a new medical technology and you are wondering if it really has value and if investors (if you are an entrepreneur) or your company management (if you are an intrapreneur) will take notice. As a product area, medical devices are unique because to be successful they must simultaneously pass through three main hoops: regulatory, reimbursement, and IP protection. The first is because medical devices are a highly regulated industry, the second is because insurance companies and not the consumers pay most of the cost, and the third is because devices are expensive to develop and take a long time to develop so IP protection is needed to retain the value of your idea.

This chapter is about the screening questions to ask yourself to objectively determine if your idea has value. These are the same questions that investors or company management will ask when evaluating your idea, and therefore are the same questions that should be answered when you are pitching your idea to others. Later chapters in this book go into depth in how you answer the question. For example, sizing the market is covered in the Understanding the Opportunity and Secondary Market Research chapters.

The 10 Questions to Ask

1. What is the Unmet Clinical Need?

An understanding of the problem you are trying to solve is essential and separates successful needs-driven innovation from technology push engineering projects. As part of this evaluation screen, you should answer these questions:

- What clinical problem does my solution solve?

- How is my solution different than what clinicians use now?

- If adopted, will my solution lead to a new standard of care?

- What first-hand evidence do I have from clinicians that this is an unmet clinical need?

- Will my solution lead to better outcomes, or lower cost, or both? Why? What is my evidence?

where Question 5 is really about the new paradigm of evidence-supported, value-based healthcare.

In this screen avoid the trap of a solution whose advantage is only to save time in the operating room. Shaving OR time only makes a difference if the time savings allow one more procedure to be scheduled for that day. Also avoid the trap of many digital healthcare ideas who claim it is an advantage for clinicians to be flooded with daily granular data from their patients. This is one criticism of a clinical motion capture diagnostic procedure to capture gait abnormalities: it produces too much information. Clinicians are busy and don’t have the time to analyze voluminous data streams so these types of digital systems only have value if they consolidate and present actionable data to a clinician efficiently.

2. Is the Opportunity Significant?

Who are the customers and what is the market size? Investors like an innovation with the potential to generate over $100M per year, but is your really in that category? Novice innovators too often use the H word (“huge market”) and the B word (“will generate billions”) but rarely is this backed up with rigorous secondary market research and an objective market size estimation. The idea could satisfy a need and could work but without market assessment it is just an academic project.

3. Is the Technology Proven?

One question to ask right away is whether this is an innovation or still at the scientific discovery stage. It is science if principles are researched and reported in peer reviewed journals to be the basis for developing a future clinically-relevant technology. It is science it the idea is still at Technology Readiness Level 1 or 2.[1]

If you are past the science stage, ask these questions:

- Have I built a working prototype?

- Do I have bench, animal, or first-in-human performance data?

- What technology de-risking is needed to get from where I am now to a commercial product?

- What evidence do I have that the technology works to its intended purpose?

4. Do I Have User Feedback?

Getting a minimally viable prototype into the hands of clinicians so they can try it in a bench mockup or an animal model is a source of important feedback on the value of your invention. A wow! demo and quotes from two key-opinion-leaders goes a long ways towards convincing investors that you have something real.

5. Do I Have Patent Protection?

A new medical device idea goes nowhere without patent protection and filing a provisional patent application should be one of your first steps after you have something to show. If you are at a university, your tech transfer office will evaluate your technology and determine whether to file a provisional.

Investors will ask you these questions about your patent protection:

- Do you have a provisional application, or a published regular patent application, or an issued patent?

- How strong are the claims in your patent or patents?

- How extensive was my patent search?

- How easy are the claims to design around? (Tip: you should be the first one to try and design around your claims.)

- Is their clarity in the ownership of the patent? (If you are at a university, it is likely that the university owns the patent.)

- Are you prepared to defend the patent should there be litigation or an invalidity challenge?

6. Is There a Viable Regulatory Approach?

- Do I know the FDA class?

- If proposing the 510(k) route, do I know the predicate product?

- Has a regulatory consultant analyzed my proposed approach?

- Have I had an initial consultation with the FDA?

An example of a challenging regulatory approach that might turn investors away would be an implantable technology that uses a new material. This is because new materials typically require full animal trials followed by full clinical trials to establish long-term safety of the new material, a process that is lengthy and very expensive.

7. Is There a Viable Path to Reimbursement?

- Has a reimbursement consultant analyzed my proposed approach?

- Does it require a new code?

- Which of the major agencies are likely to reimburse: CMS? VA? Blue Cross/Blue Shield? Others?

8, What is the Competition Doing?

- Have I done a freedom-to-operate patent search?

- Have I done a literature review of peer-reviewed academic publications to understand what has gone on in research labs around the world?

- Do I know what other startup companies around the world are doing?

- Do I thoroughly understand what directly and indirectly competing commercial products are on the market?

- Have I searched the FDA database to know all of the related Class I, II, and III devices are listed?

9. Who is on My Team?

Even if you are an academic and in the research stage operating under university internal or government funding, at a minimum you need engineering and clinical co-investigators on the research team as both should be driving the project. If you are a startup or pre-startup, then investors look closely at your proposed management team, which should have experienced technical, clinical, and business experts. Having a seasoned CEO is an advantage. If you are a startup, form a medical advisory board and a scientific advisory board for your company. Often, that is the first place investors will look when they are on your website.

10. What are the Remaining Risks?

Knowledge of the remaining unknowns and having a de-risking plan is critical for early-stage activities. The primary risks could be technical (does it work and can we build it to scale?), or clinical (what type of clinical trial is needed?) or market development (how do we convince users to adopt and how do we penetrate the market?)

Additional Considerations

Depending on where you are along the innovation path, you should also consider these questions:

- What do the financials look like? What is the predicted cost-of-goods-sold (COGS) and what is the anticipated selling price? This along with the estimated market size can be used to determine sales potential.

- What is the expected market penetration rate? Novice entrepreneurs wrongly assume they will capture large market shares after a year or two but this rarely happens in the medical device world where sometimes it can take decades for a new idea to catch on.

- Can I explain my idea? Is it easy to explain? Do I have a great prototype or animation to demo?

- What is my go-to-market or exit strategy? Am I looking to produce and sell the product? Do I want to license or sell the idea?

The Key Considerations for Investors

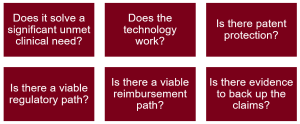

Your idea will be considered by investors if you are far enough along to have first-hand evidence that your device works on the bench, in an animal model, or in a first-in-human study. Investors won’t be interested in a napkin sketch or an animation, although it is sometimes useful early on to do informational interviews with potential investors to explain where you are in the process and to keep the lines of communication open. Once you are far enough along, while all of the questions in the previous section are important, the key screens used by investors and company management are summarized in this diagram:

And, while these screens are key, as one business analysist for a medical technology strategic who evaluates hundreds of opportunities each year puts it, “I get interested when my gut reaction to the concept is, ‘I wish I had thought of that!'”