17 Intellectual Property Strategy for the Early Stage Medical Device Business

David Black

IP Assets as a Business Value

For many medical device businesses, a substantial portion of the business value is represented by the intellectual property assets. A prudent IP strategy provides that these assets are properly recognized, well-protected, and judiciously deployed for the benefit of the shareholders. This chapter describes elements of a typical IP strategy, and for your particular early stage medical device technology company, these recommendation must be adjusted to align with your business objectives for growth, available budget, resources, and timeline.

A robust IP portfolio will include a balanced mix of copyrights, trademarks, trade secrets, agreements, and patent assets. For example, corporate documents, agreements, advertising, marketing and other such material are probably eligible for copyright protection. Copyright protection is very low cost and is to be viewed as low-hanging fruit for capture. Material that provides a competitive advantage if maintained in secrecy is likely to be a suitable candidate for trade secret protection. Trade secret material can be protected by a schedule of protection measures for preventing discovery by unauthorized personnel. A patent can be viewed as the opposite end of the spectrum from a trade secret; the patent application is laid open to the public.

You will need patent counsel input to help develop and deploy your IP strategy. Counsel will be able to help you select those innovations suited for trade secret protection or patent protection, select marks for trademark protection, and select materials for copyright protection.

For those innovations earmarked for patent protection, good counsel can also assist in developing a filing plan, provide guidance on subject matter for inclusion, and write claims consistent with the IP strategy. In particular, changes in the law, the regulatory framework, business strategy, resources, competitive pressures, and many other factors will play an important role in making choices consistent with a comprehensive intellectual property strategy.

To preserve capital and build an IP portfolio in a cost-effective manner, an early stage company should concentrate on a blended approach including domestically filed patent and trademark applications, carefully selected international filings, selective use of freedom to operate analysis, leveraged post-grant review opportunities, and thoughtful controls on the rate of prosecution.

Patent Timeline

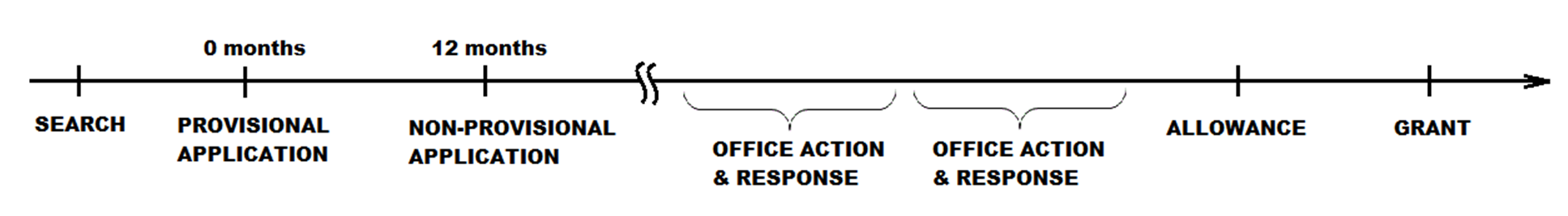

A typical patent application timeline is illustrated in the figure above. Before filing a patent application, a search of the relevant art should be conducted either by the company or by a patent attorney. The figure illustrates filing a United States provisional application at time 0 months. The application should reflect the findings of the search. At a time no later than 12 months thereafter, a non-provisional application is filed. In due course, the US patent office will conduct their own search and examination and provide feedback in a document known as an Office action. To advance prosecution, the applicant is required to respond to each Office action with a written response. The example illustrates two such cycles followed by a notice of allowance and then grant. A typical duration for the illustrated process is several years.

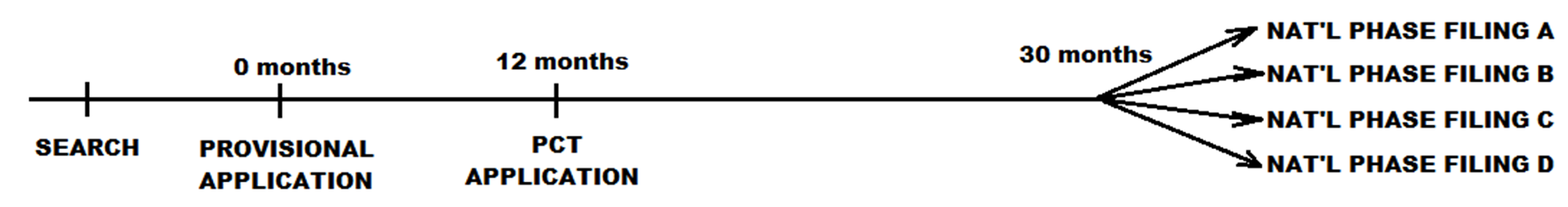

The next figure illustrates an international application filing timeline. Here, the applicant has filed an application under the terms of the Patent Cooperation Treaty (PCT) no later than 12 months after the US provisional application filing date. The PCT application is processed in accordance with rules of the World Intellectual Property Organization and following this proceeding, the example applicant has filed national phase filings in four countries (or regions). Each national phase filing proceeds much like that at the US in terms of Office actions and responses. Notably, a PCT application does not, in and of itself, result in a PCT patent or an international patent.

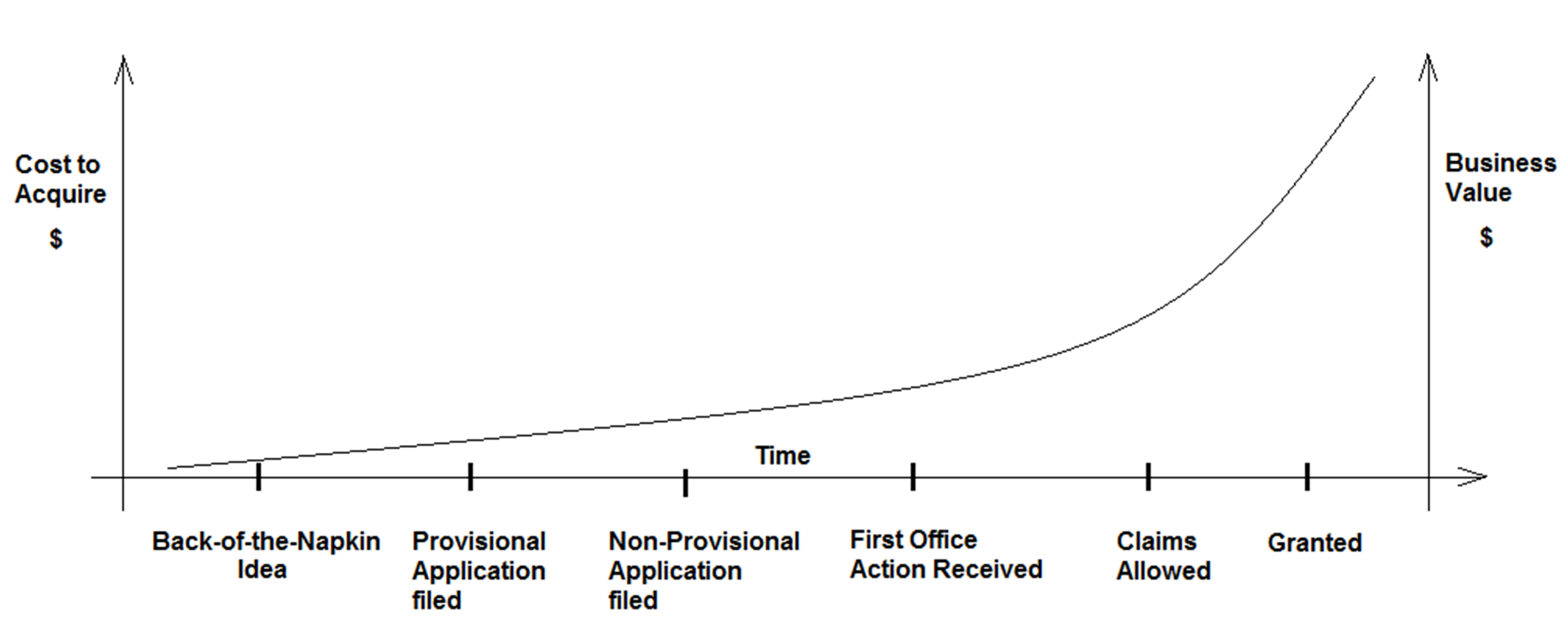

An investor in the new business will be interested in reviewing any patents held by the company. Investors often use the IP portfolio as a proxy for business value. Sophisticated investors understand that a pending provisional application is better than a back-of-the-napkin idea but not as impressive as a comprehensive portfolio of several patents, or even just one patent. Investor confidence will increase as the IP portfolio matures. Patent office validation of the core innovation inspires investor confidence. Patents also can help trigger buying decisions by customers, attract business partners, and attract qualified employees. The relationship between portfolio maturity and cost (or value) can be represented by the graph shown in the figure below.

With this understanding, it makes sense to allocate resources to aggressively develop a patent portfolio. Various tactics can be employed to accomplish this. For example, a patent applicant can leverage the opportunity to control the pace of the patent application prosecution timeline (between the filing date of the application and grant date of the patent). The US Patent and Trademark Office offers several tools to accelerate the application process. For example, an applicant can pay a fee and request expedited processing and expect final determination of allowance or rejection in under 12 months. Other options are available for advancing the application to the front of the prosecution queue. For example, favorable treatment of a similar application in a first country can be leveraged to expedite prosecution in a second country.

For some businesses, rather than accelerating, it may make sense to reduce the rate of prosecution. For example, patent applications directed to certain software technologies are currently struggling with patent office guidelines that may deny grant of a patent. By inserting a delay in the prosecution, the applicant may be able to shift the timeline to a period where a more favorable review is possible. For these technologies, it may make sense to leverage opportunities to slow the rate of prosecution. Tactics here can include filing a PCT application, filing an appeal to the Board of Patent Appeals and Interferences (PTAB), filing a provisional application, withholding payment of official fees at time of filing an application, and buying extensions to allow filing of a delayed response.

Experienced patentees also recognize that prosecution time and cost is related to claim breadth. In other words, a broad claim will be examined relative to a larger body of prior art and a narrow claim will be examined relative to a smaller body of prior art. Overly broad claims can drive costs during prosecution and later, when the patent is asserted, broad claims may leave a competitor with a viable defense against a charge of infringement. Right-sized claims have the proper breadth, are not excessively costly to prosecute, and when granted, are fully defensible. Keep in mind that a continuation application can be filed to incrementally acquire broader overall coverage.

IP Landscape Audits

As the company grows, it may be valuable to conduct periodic IP audits. An audit can reveal findings that can provide feedback for the IP strategy. An IP audit can reveal flaws in ownership records for patent assets, identify those patent assets worthy of further maintenance fee payments, identify those applications that should be abandoned, and identify those IP assets that are well-suited for disposition via licensing, donation, or as part of a tax strategy. An IP audit can also include a critical review of agreements, licenses and joint ventures and ensure that ongoing obligations are being met. Most importantly, an audit should include a review of the current offerings of commercial products and services and evaluate alignment between these offerings and the IP portfolio.

The company should be ever vigilant for imminent disclosures of new products and innovations because a sale event or a disclosure before having filed an application can impair or preclude patentability. Ensure that any innovation likely to arise in the course of the disclosure is either already patented or ensure that a corresponding patent application is already pending. Disclosures can take the form of an exhibit at an industry conference, a press release, or a published manuscript. The scope of the disclosure should be reviewed carefully relative to currently-filed patent applications.

Strategy for IP Filing

The med tech company should develop a balanced plan for filing both offensive patent applications and defensive patent applications. A defensive patent application can ensure that others are unable to block core activities of your business. An offensive patent application can erect a barrier to exclude a competitor from accessing technology of interest to your business. An offensive patent can cover technology that may be in a related field or cover ideas that are not seen as core to the company business. A patent can be viewed as a bargaining chip that can be licensed to others or asserted as counter-measures in the event the company is the target of an infringement challenge.

A sophisticated patent strategy can include filing applications in areas selected to anticipate the business goals of the competition. Insightful analytics and trend analysis can help the company identify the development direction of the competition. Resources dedicated to developing solutions in these areas can pay dividends when the competition discovers that your company already has patents in place.

Budgeting resources for development of the patent portfolio is essential. This entails forecasting company growth rates and patent application filing plans. Set a reasonable budget for each patent application at the outset, but as technologies are developed, and at the time of deciding to file a patent application, ascribe a value to the subject technology and make budget adjustments accordingly. If, on the other hand, the company allocates a fixed budget to each patent application without discriminating as to relative value, then some matters will be over-funded and others under-funded.

The company should create a documented program by which patent application decisions are made. For example, the program can establish a patent review board and include guidelines for uncovering innovations and selecting those suitable for patenting. The members of the review board should include patent counsel and include folks from marketing and from research and development.

To meet a filing target, the company should proactively encourage all employees to come forward with clever innovations. For example, in the product development process, the company should conduct blue-sky brainstorming sessions in which all ideas are unconditionally supported. The results of a brainstorming session can be evaluated according to the company’s IP strategy; some ideas will be suited for trade secret treatment and others are likely candidates for patenting.

Foreign patent protection is generally costly. For many early stage medical device companies, the prudent course entails filing primarily in the United States, and filing internationally for only a small number of innovations. Those innovations having the greatest promise for licensing or the best prospects for blocking a competitor should be carefully chosen and earmarked for a foreign patent application. A variety of international filing strategies are available but for many innovations, a PCT filing provides a reasonable gateway to later national phase filings.

The company should watch for opportunities to file a design patent application. A design patent is directed to ornamental aspects of an innovation rather than functional aspects. Prosecution is rather quick, the patent term is shorter than that of a utility patent, and there are no maintenance fees.

The company should ensure that existing opinions of counsel are properly maintained and updated as appropriate. Importantly, the company must ensure that the commercial products are consistent with the advice of counsel as to a freedom to operate opinion. For commercial offerings that are not already covered by an opinion of counsel, the company should carefully consider the merits of evaluating and obtaining an opinion.

The low-cost opportunities presented by US post-grant procedures can be leveraged. For example, the company can consider clearing troublesome patents using the inter partes review mechanism. In addition, the company can monitor the inter partes challenges lodged against competitors and adjust course accordingly. This can include bolstering IP rights with an eye towards discouraging third party challenges.

Growing a successful company in the medical device space is complex. The nascent company should strive to create a business culture that nurtures genuine respect for all intellectual property. This involves educating all employees regarding the fundamental principles of intellectual property.

The smart company, in coordination with advice from competent legal counsel, will leverage its IP opportunities to ensure its success and longevity. Further, the smart company will periodically review its IP strategy and routinely adjust the strategy to reflect changes in the business climate, growth plans for the business, changes in the law, and changes in the technology.