3 Understanding the Opportunity

Ben Arcand

Once a compelling clinical need has been identified, it can be tempting to jump directly to developing solution concepts. However, it is imperative that in-depth understanding of important information about the opportunity is achieved. This includes understanding the disease and how it is currently treated, what the market size for the opportunity and what competitors are doing. This understanding will be critical for high-level VOC discussions with physicians and for future refinement of concepts.

Researching the Disease State

Researching the disease state has the four components that are described in the following sections.

Anatomy

Anatomy is the structure and naming of the relevant organs and tissues, and also the variety and variances of these structures in the population. Gaining a deep understanding of the anatomical structures and nomenclature will be invaluable when discussing need and solutions with clinicians. Additionally, information on sizes and variations will be needed for designing potential solutions.

Physiology and Pathophysiology

Physiology deals with the function of organs and tissues and pathophysiology with the dysfunction of organs and tissues due to disease. Function, and dysfunction in the case of disease, is essential knowledge if you are to develop solutions to move towards a cure or reduction of symptoms. How a disease presents in the clinic, with what symptoms, and how the final diagnosis is made all inform on how a patient will move through the care system and ultimately to a treatment. Understanding the comorbities that typically present with the disease, for example obesity or other diseases, will inform on some of the challenges that may need to be met when designing a solution.

Epidemiology

Epidemiology is the prevalence, incidence and distribution of a disease. Prevalence is the proportion of a population found to have a condition while the incidence is the rate of occurrence of a disease in a population over a time period (usually 1 yr). The distribution of the disease among different segments of a population such as men vs women or different age ranges is also important. The rates of incidence and prevalence reported in literature can be highly variable depending on methods used and the population that was studied. Careful reading may be required to understand why one researcher reports several times the prevalence rate of another researcher. A meta-analysis that retrospectively assesses past research can be useful in understanding these results, if available. In any case, a range of the number of patients currently suffering from a disease (prevalence) and the rate at which new patients are acquiring a disease (incidence) will be necessary to assess the importance and potential market for a solution.

Care Pathway

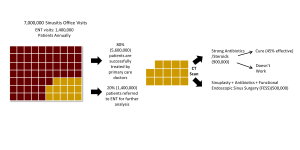

The care pathway describes the steps that a disease state or condition progress through the healthcare system. Typical steps may include diagnosis, referral to specialist, treatments performed, and outcomes of treatments. The care pathway is a concept describing how a disease is identified in a patient, by what care professionals, in what clinical setting, how that disease is treated and the outcomes of those treatments. This information can be critical for crafting how and where a solution may be administered and by what type of practitioner. Often a disruptive new solution to a clinical need may involve changing how a disease is identified, or the setting and by whom administers a treatment. Equally important is an understanding how patients drop out of the care pathway through frustration, cost or a lack of results.

Here is an example care pathway assessment for treatment of individuals with chronic sinusitis:

Resources for Conducting Your Research

- PubMed A free resource that is developed and maintained by the National Library of Medicine (NLM), which is part of NIH. PubMed is the most comprehensive database of peer-reviewed academic literature. PubMed is easy to use and every medical technology project should do a PubMed search to further understand the disease state and the current state of research on treatments and devices.

- MedlinePlus Another service of NLM and contains excellent tutorials on health conditions and diseases.

- NIH Each institute of NIH has a resource page that describes the basics of disease and disorders relevant to that institute. For example NINDS on its “Disorders A-Z” page has tutorials on every known neurological disorder.

- UpToDate A subscription-based clinical decision support resource that is continuously updated to ensure the content stays current. Useful for understanding the consensus opinion for treatment plans.

- Videos of Procedures MedlinePlus maintains a comprehensive set of links to high-quality videos of surgical procedures. Other videos can be found on YouTube.

Sizing the Market

Most medical device innovators get into this field because of a desire to help patients and have a positive impact on healthcare and medicine. Profits are usually not the prime motivator; however, developing a medical device is typically a long-term and expensive proposition that requires a comparable potential for market size and sales to justify making the large up-front investment.

Understanding the market and potential return on investment is therefore an essential part of evaluating whether to work towards a potential solution to an unmet clinical need. If the potential innovation won’t survive as a successful product, then it won’t exist or be available long enough to help patients and doctors.

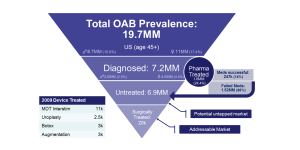

The epidemiological and clinical pathway data uncovered when researching the disease state can be used to analyze and estimate market sizes. In the following figure, the care pathway and epidemiological data for overactive bladder is outlined in an inverted pyramid diagram showing the segmentation towards the likely patient and market segment. In this case, out of the estimated 19.7 million people with overactive bladder in the U.S., 7.2 million are diagnosed and only 20k and 247k being treated surgically or successfully by pharmaceuticals respectively.

In this example, the purpose of this unmet clinical need is for a better surgical solution. This leaves 6.9 million patients untreated which would equate to an untapped potential market and 20k as the current addressable market for those currently selecting surgical solutions to their OAB. If we estimate a potential price for the solution (based on costs of current solutions), we can get rough market estimates that can be later refined as more is learned. In this case, the market currently supports about $1,000 for surgical devices making.

Current market size: 20k * $1000 = $20M market

Potential market size: 6.9M * $1000 = $6.9 B

As rule of thumb, a market size that will support the cost of development and clinical trials for a PMA device is at least $500M. Refinement of the market size estimates can be achieved as a better idea on the patient segment, cost-of-goods (COGS) for the solution and the business model are developed.

The handbook chapter on secondary market research provides methods and resources for determining market size.

Analyzing the Competition

An examination of the competitive solutions that are currently available and under development will help in the refinement of your business model and clearly differentiate how features of your innovation will provide for a better solution and compete for market share when available. Through literature searches and voice-of-the-customer interviews, a number of products, pharmaceuticals, treatments and surgical techniques have most likely surfaced. The various attributes of each solution should be cataloged in a simple table that might include these headings: Cost, Features and Attributes, Caregiver, Special Training Required, Pros/Cons, Outcomes, Where Treatment Performed, Patient Segment Treated, Business Model (e.g. single use, capital equipment, marketing strategy), Market Share (rough estimate).

Here is an example for exploring opportunities in the overactive bladder space.

| Product | Features | Venue | Outcomes |

| Implantable stimulator | Minimally invasive surgery. Screening step. Low effectiveness. | O.R. | 60% efficacy |

| Percutaneous tibial nerve | No surgery or drug side effects. Multiple visits needed. | Office | 77% moderate improvement |

| Botox injections | Reversible and minimally invasive. Off label use. Continuous injections needed. Low effectiveness. | Office | 12-50% efficacy |

| Implantable drug delivery | Single visit for long dosing. Effectiveness TBD. | Office? | TBD |

| Bladder balloon | Office implantable device. Removable. | Office? | TBD |

| Bladder replacement | New organ created from patient cells. Major surgery. | O.R. | TBD |

ClinicalTrials.gov is a comprehensive, searchable database of federally and privately supported clinical trials in the USA and around the world. A ClinicalTrials.gov search is a good way of finding out what the competition is doing.