11 Pitching Your Idea

Tim Laske

The Basics

“Pitching your idea” means you have an opportunity to present your concept for a new medical device to potential investors, to a company that might acquire your startup enterprise, or to management if you are in an established company. No matter which situation you are in, these rules apply:

1. Know what you want to accomplish with the pitch

2. Understand your potential investor/acquirer

3. Be clear on the value you provide

4. Be clear on what you want

5. Leave adequate time for discussion

Most importantly, know what you want to accomplish. The presentation must support your goals and don’t spent too much time on the technology because they will care more about the value it provides than the engineering behind the concept. Is the goal to inform? To update? To convince? To buy? To sell? To impress your boss?

Time Matters

Time matters when pitching because it will invariably be limited and you will be dealing with an audience of very busy executives. Sometimes you will have five minutes (for example, a conversation in a hallway or an elevator) and sometimes you will have two hours. No matter how much time you have, don’t waste it. If you can present everything in an hour, do so; less is better. Even though you won’t likely have your preferred amount of time, make sure to leave adequate time for discussion. A rule of thumb is 60-40 for per cent presentation and discussion. So if you have an hour, your presentation should be about 35 minutes.

Understand Your Audience

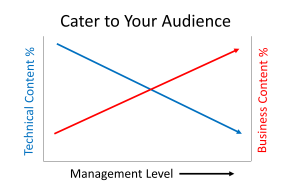

Do your homework on your potential investor/acquirer prior to the meeting, including finding out who they are, what they need and why they might want to listen to the opportunity you plan to present. Many times we have had a potential partner refer to our company as “Medtronics” vs “Medtronic” (the proper name). In this case, they clearly did not do their research.

In addition to a pure financial transaction, your audience might be a potential partner, so determine their competencies and how you might complement them. Find out some of their past failures/successes and their current financial position.

Do not try to pitch the CEO of the target company, instead your entry point to the company is through those whose job it is to evaluate clinical and business opportunities. Only after opportunities are vetted for technical and financial feasibility/fit will they be presented to the CEO.

Be Clear on Your Value

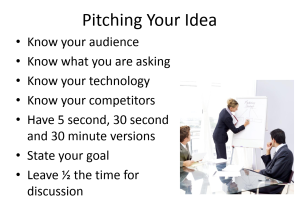

Be clear on the value you provide and be explicit about what you are asking for. You should have reasonable estimates backed up by data from credible sources of your clinical or market value, including your competitive advantage. Your investment or acquisition audience will likely know the market space as well, and maybe even better than you, so do your homework.

Importantly, you should be clear about what risk has been eliminated from your opportunity and what risk remains. In general, you want to burn down the risk early and failing fast is far better than failing later.

Don’t be tempted to oversell your opportunity, which typically takes the form of stating that you will capture wildly optimistic market share with high average selling prices and aggressive growth. Rather, model ‘best case’, ‘worst case’, and ‘most likely’ scenarios. Also, don’t undersell the remaining risk, implying that only “mop up” work remains to get to product launch. Remember, more technology typically equals more hurdles and generally higher inherent risk in relation to bringing a product to market. For example, new biomaterials used in a Class III device inherently creates technical and regulatory risk.

Keep in mind that decisions rarely occur in the pitch meeting, so stating what you want during the meeting is even more important.

Anticipate Their Questions

Anticipate their questions by finding out their top three issues, and then address those issues in your pitch. For example, project timing risk will generally be one of their questions.

Your IP position is likely to be another key topic of discussion. State the strength of your IP portfolio, remembering that even granted claims can be proven invalid. Make sure there is absolute clarity on ownership of your IP. Think carefully about whether and how your IP can be designed around. In fact try the exercise of designing around your own IP before others do so.

Communicating Complex Ideas

New medical device concepts are often complex and your audience may not be experts, so use all the tools available to you to help you tell your story. This includes demonstration hardware, animations, video from using a prototype and explanation of predicate products. If they do not understand the opportunity … it’s ‘Game Over.’

Know What You Want

If you say, “We are open to a number of deal structures,” your audience will hear, “We don’t know what we want.” So instead, be clear on what you want: A passive investment? A strategic investment? Do you want to be acquired?

Pitch Tips

- Use your strongest presenter(s), who may not be your company CEO and may not be your chief engineer.

- In your pitch, you are selling the clinical and investment opportunities, not the product.

- Short forms of the pitch are equally important. Can you make a compelling statement for your idea in one sentence?

- Spend no time describing how hard it was to develop the product.

- Cite credible sources to back up your assertions.

- Format every slide with the title making your point and the body of the slide providing evidence to back up your assertion.

- Use pictures and graphs whenever possible.

- Come prepared and arrive early. (But expect the meeting to start late.)

- Dress appropriately.

- Be humble but confident; prepared but not scripted.

- Practice, practice, practice!